How to calculate carry and roll-down (for a bond future's asset

4.5 (741) · $ 10.00 · In stock

Fixed income: Carry roll down (FRM T4-31)

Short-Term Bonds: A Point of Potential Opportunity on the Yield Curve

Cross-asset carry: an introduction

A Bond Convexity Primer CFA Institute Enterprising Investor

Fixed income: Carry roll down (FRM T4-31)

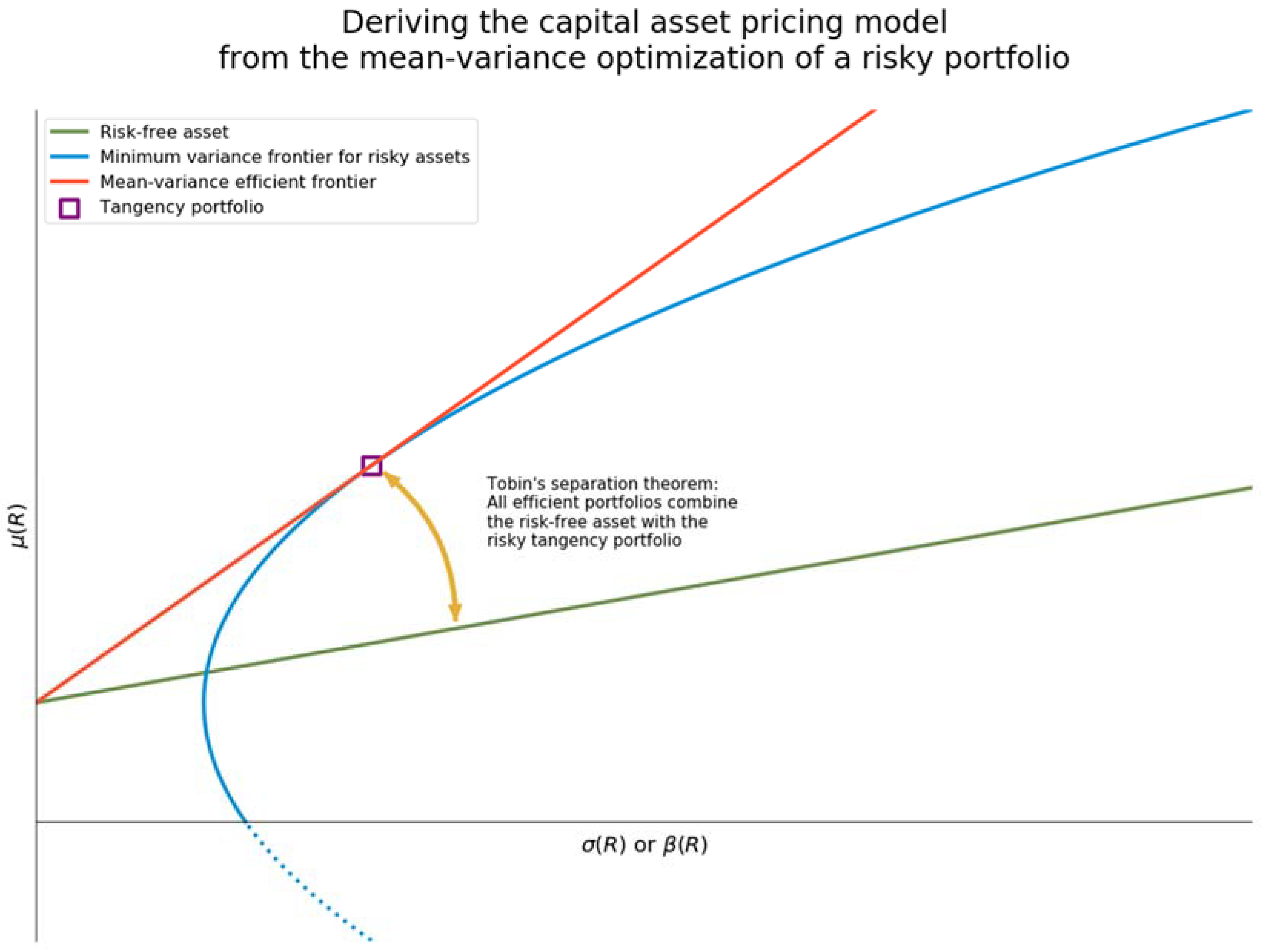

Encyclopedia, Free Full-Text

Contango - Wikipedia

On the finer details of carry and roll-down strategies

Carry and Roll-Down of USD Interest Rate Swaps in Excel with

You may also like