Value-Added Tax (VAT)

4.9 (142) · $ 13.99 · In stock

:max_bytes(150000):strip_icc()/Value-Added-Tax-bfc9359a52f74ae9a430d4c2d7ce91e2.jpg)

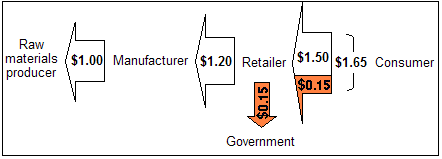

Value-added tax (VAT) is collected on a product at every stage of the supply chain where value is added to it, from production to point of sale.

Value-Added Tax (VAT) Definition, How It Works, and Purpose

European e-commerce market knowledge: Value Added Tax (VAT) - e+

upload.wikimedia.org/wikipedia/commons/2/28/VAT3b2

upload.wikimedia.org/wikipedia/commons/8/83/VAT2b2

Value-Added Tax (VAT) Bases in Europe

Value Added Tax (VAT) – Page 2 – BRT-News

Value-Added Tax (VAT): Definition, Meaning, Guide, Examples - 10XSheets

Value Added Tax (VAT) eCommerce App

.png%3Falt%3Dmedia&w=1920&q=75)

Understanding and Calculating Value-Added Tax (VAT)

Value Added Tax: the most insiduous of all taxes

Value Added Tax (VAT) - Overview, How To Calculate, Example

Value added tax: VAT: Exploring the Impact of VAT on the Tax Wedge - FasterCapital

Value-Added Tax (VAT): A Guide for Business Owners - SmartAsset