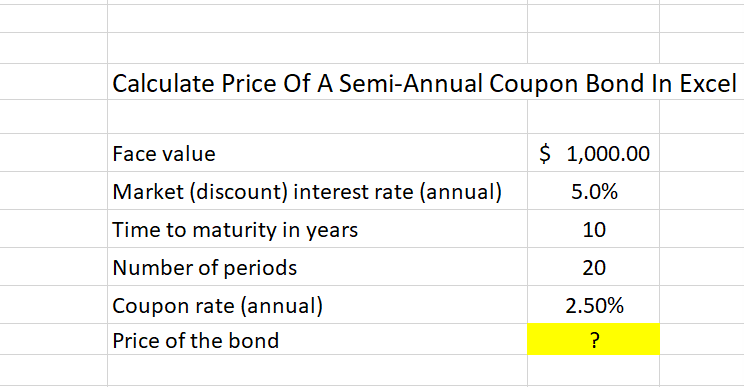

Solved Calculate Price Of A Semi-Annual Coupon Bond In Excel

4.8 (680) · $ 5.50 · In stock

Answer to Solved Calculate Price Of A Semi-Annual Coupon Bond In Excel

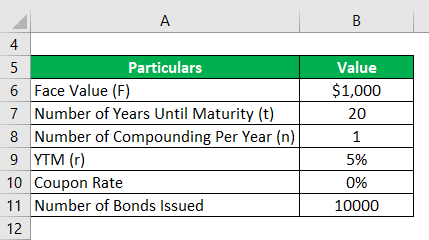

Learn to Calculate Yield to Maturity in MS Excel

How to Calculate YTM and effective annual yield from bond cash flows in Excel « Microsoft Office :: WonderHowTo

Bond Formula, How to Calculate a Bond

Calculate the price of a 5.7 percent coupon bond with 22 years left to maturity and a market interest rate

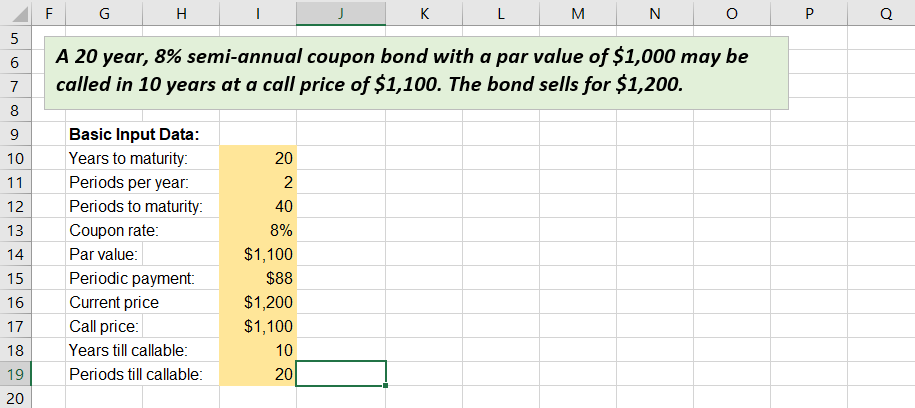

Solved A 20 year, 8% semi-annual coupon bond with a par

Bond Formula, How to Calculate a Bond

Consider a bond paying a coupon rate of 12.00% per year semi-annually when the market interest rate is only 4.8% per half-year. The bond has five years until maturity. a. Find the

Coupon Rate Formula + Calculator

Solved] A bond (semi-annual payments) currently has a price of $1,050, a

Learn How to Calculate Bond Price / Value - Tutorial, Definition, Formula and Example

Yield to Maturity (YTM)

:max_bytes(150000):strip_icc()/sq-c93ea3598e9a4d388cbd448a4d5850d0.jpg)

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/metroworldnews/7B5VWAR2MBHUVOQY2H4SPJMGRE.jpg)