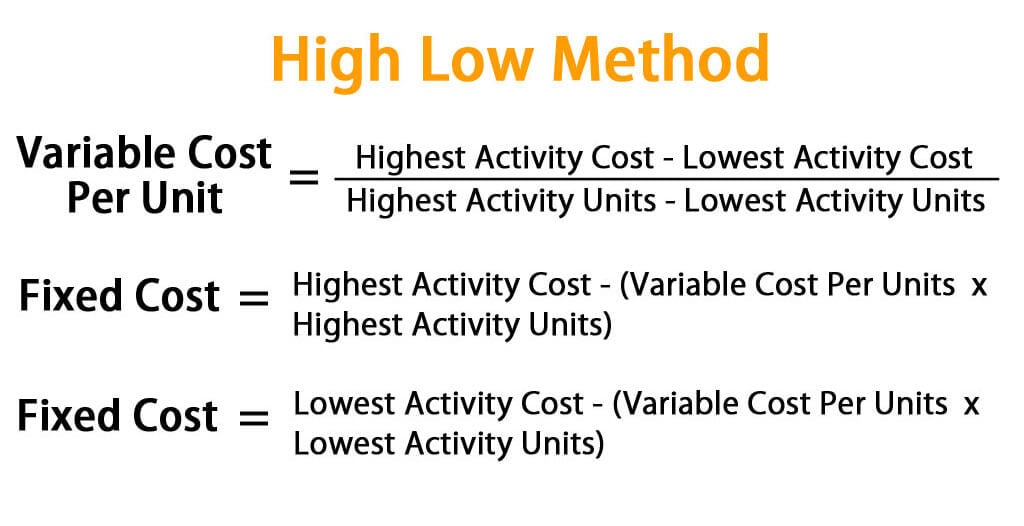

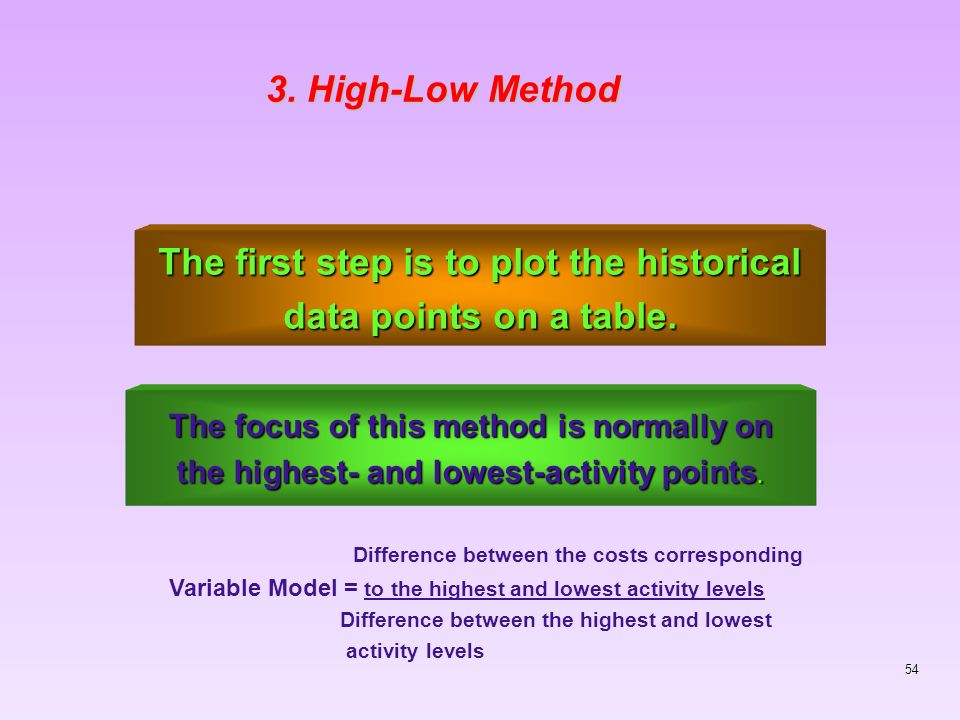

High-Low Method Definition

4.9 (290) · $ 7.50 · In stock

:max_bytes(150000):strip_icc()/high-low-method-4195104-4x3-01-final-1-4a515f17b88946c89aea45241a23dc1e.png)

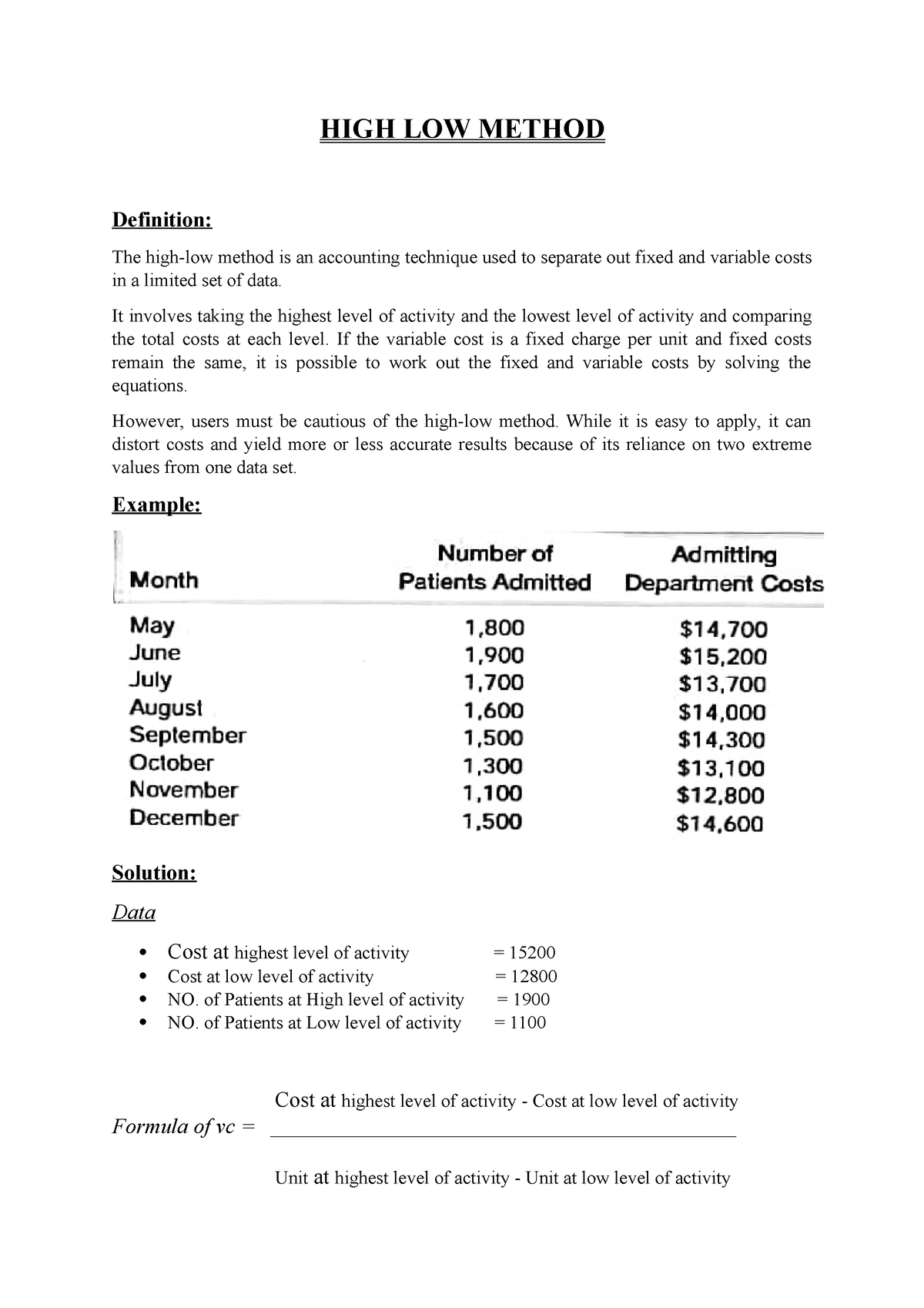

In cost accounting, the high-low method is a way of attempting to separate out fixed and variable costs given a limited amount of data.

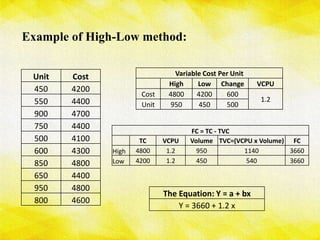

High Low Method Calculate Variable Cost Per Unit and Fixed Cost

Price Earnings Ratio - Formula, Examples and Guide to P/E Ratio

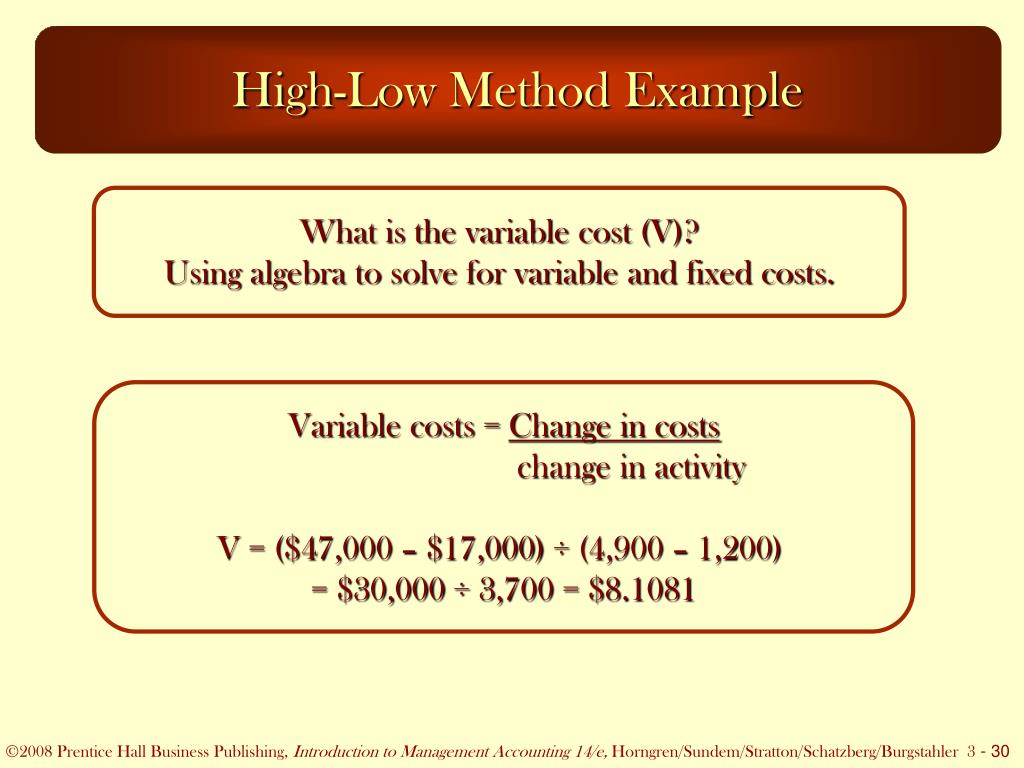

MBA: MANAGERIAL ACCOUNTING - ppt download

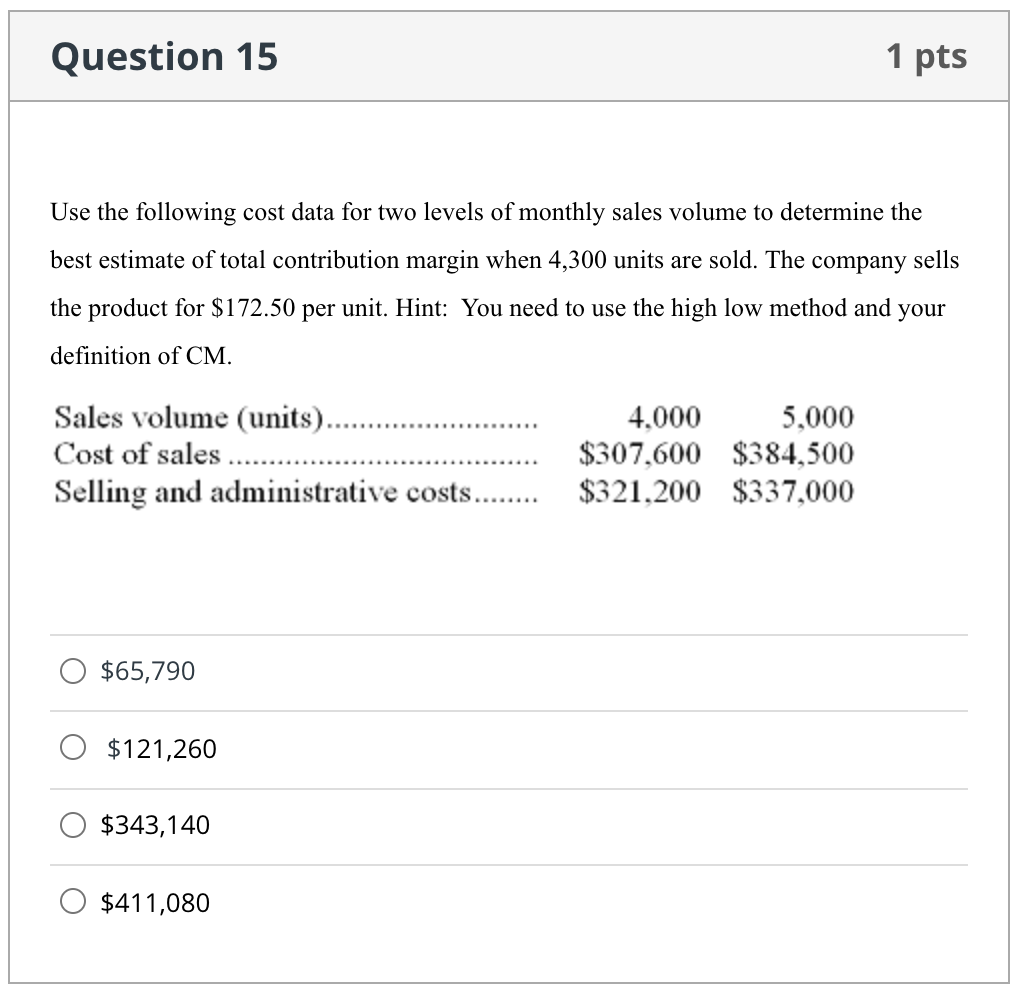

Solved Question 15 1 pts Use the following cost data for two

HIGH LOW Method - HIGH LOW METHOD Definition: The high-low method is an accounting technique used to - Studocu

Presentation on Methods of Determining Cost Behavior

What Is Per Diem? Definition, Types of Expenses, & 2024 Rates

Highest Lowest Activity Levels - FasterCapital

PPT - Introduction to Management Accounting PowerPoint Presentation, free download - ID:1097659

)